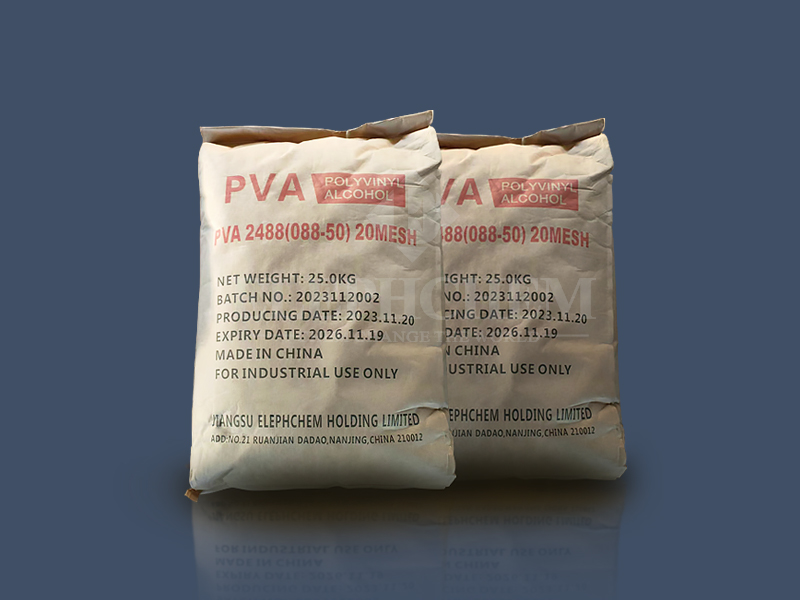

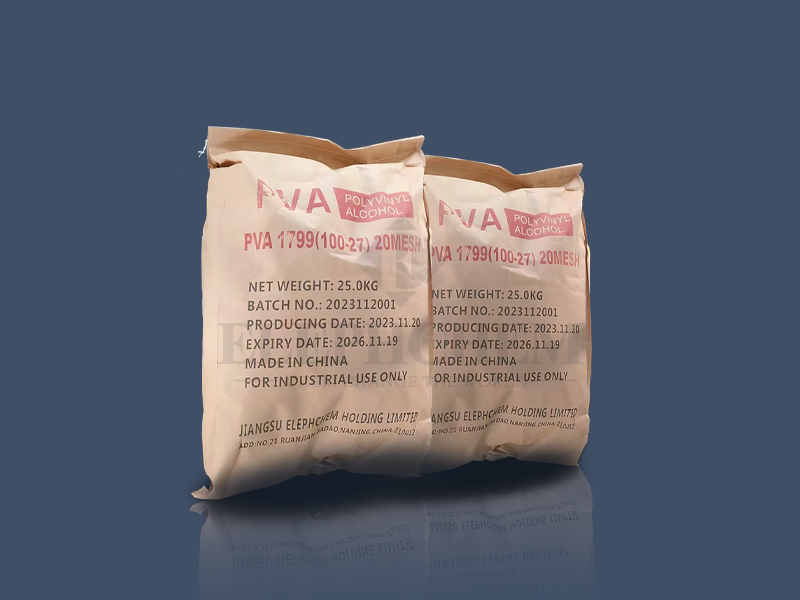

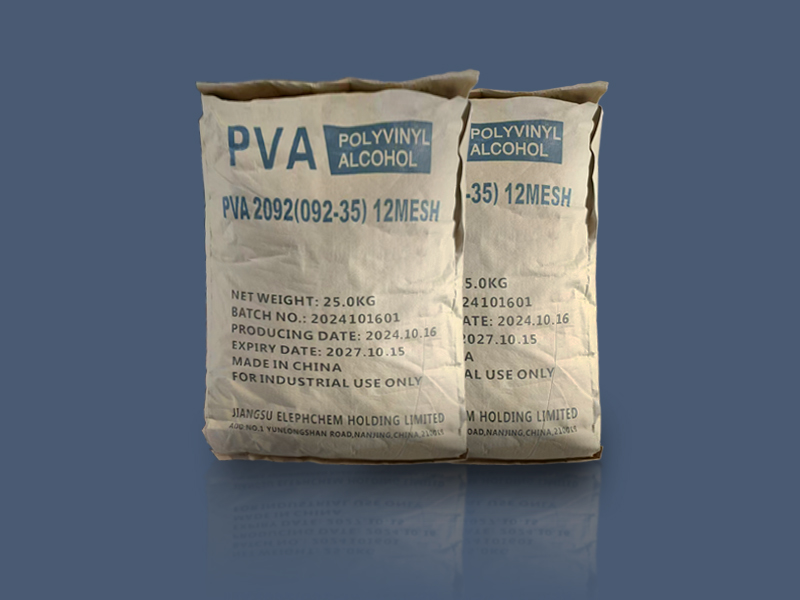

General properties Product name: Vinyl Acetate Ethylene Copolymer Emulsion Other name: Vinyl acetate-ethylene copolymer emulsion, VAE emulsion, VAE dispersion, Ethylene-vinyl acetate copolymer emulsion, EVA emulsion, Ethylene-vinyl acetate copolymer dispersion, EVA dispersion. Appearance: VAE Emulsions are milky white or yellowish. Product Summary Grades Solid content(%) Viscosity (mpa.S/25℃) PH VAC(%) Ethylene(%) Glass transition(Tg/℃) Minimum film forming temperature CW 40-600 ≥60.0 900-2000 4.0-6.5 ≤0.30 16.0-20.0 -1~1 <0 CW 40-602 ≥60.0 2500~4000 4.0-6.5 ≤0.30 16.0-20.0 1~3 <0 CW 40-705 ≥54.5 1500~2200 4.0-6.5 ≤0.20 15.0-19.0 1~3 <0 CW 40-707 ≥54.5 500~1000 4.0-6.5 ≤0.20 15.0-19.0 3~5 ≤1 CW 40-707H ≥54.5 1000~1500 4.0-6.5 ≤0.20 15.0-19.0 - ≤1 CW 40-716 ≥54.5 3300~4500 4.0-6.5 ≤0.20 15.0-19.0 1~3 <0 CW 40-718 ≥55 500~1500 4.0-6.5 ≤0.20 18.0-22.0 -6~-3 <0 CW 40-756 ≥54.5 4500~6000 4.0-6.5 ≤0.20 18.0-22.0 -5~-3 <0 CW 40-758 ≥54.5 2000~4000 4.0-6.5 ≤0.10 5.0-11.0 19~21 ≥7 CW 40-905 ≥54.5 1500~2500 4.0-6.5 ≤0.20 15.0-19.0 1~3 <0 CW 40-906 ≥54.5 3000~3800 4.0-6.5 ≤0.20 15.0-19.0 1~3 <0 CW 40-907 ≥54.5 500~1000 4.0-6.5 ≤0.20 15.0-19.0 3~5 ≤1 CW 40-916 ≥54.5 3300~4500 4.0-6.5 ≤0.20 15.0-19.0 3~5 <0 CW 40-937 56.5-58.5 3500~4500 3.5-4.4 ≤0.10 18.5-20.5 -4~-2 ≤1 CW 40-960 ≥60.0 500~2000 4.0-6.5 ≤0.30 16.0-20.0 1~3 <0 CW FS-Ⅰ ≥54.5 600~1200 4.0-6.5 ≤0.10 15.0-19.0 -1~2 ≤1 CW FS-Ⅱ ≥54.5 500~1300 4.0-6.5 ≤0.10 15.0-19.0 -1~2 ≤1 CW FS-Ⅳ ≥54.5 900~2000 4.0-6.5 ≤0.10 15.0-19.0 -1~2 ≤1 CW JF-Ⅰ ≥54.5 800~1500 4.0-6.0 ≤0.20 11.0-13.0 - ≤2 CW FH-Ⅰ ≥54.5 3300-3800 4.0-6.5 ≤0.20 15.0-19.0 -2~1 <0 CW FH-Ⅱ ≥55.0 5500-8500 4.0-6.5 ≤0.20 15.0-19.0 2~1 <0 CW FH-Ⅲ ≥60.0 3000-5000 4.0-6.0 ≤0.30 15.0-19.0 -1~3 ≥2 CW JZ-Ⅰ ≥54.5 500~1000 4.0-5.5 <0.008 14.0-18.0 3~5 ≤1 CW JZ-Ⅱ ≥54.5 1800~2500 4.0-5.5 <0.008 14.0-18.0 3~6 <0 CW JZ-Ⅲ ≥54.5 3000~5000 4.0-5.5 <0.005 14.0-18.0 3~6 <0 SG-1 ≥50 1000~2500 4.0-6.5 Ecological sand fixing agent Applications Grades Wood working Packages Plastic film lamination Publishing Paper products Architectural Coatings Textile Non-woven fabric CW 40-600 ● ● ● ● ● ● CW 40-602 ● ● ● ● ● ● CW 40-705 ● ● ● ● ● ● ● CW 40-707 ● ● ● ● ● ● ● ● CW 40-707H ● ● ● ● ● ● ● ● CW 40-716 ● ● ● ● ● ● ● CW 40-718 ● ● ● ● ● ● CW 40-756 ● ● ● ● ● ● CW 40-758 ● ● ● ● ● ● CW 40-905 ● ● ● ● ● ● ● CW 40-906 ● ● ● ● ● ● ● CW 40-907 ● ● ● ● ● ● ● ● CW 40-916 ● ● ● ● ● ● ● ● CW 40-937 ● ● ● ● ● ● CW 40-960 ● ● ● ● ● ● ● CW FS-Ⅰ ● ● ● CW FS-Ⅳ ● ● ● CW JF-Ⅰ CW FH-Ⅰ ● ● ● CW FH-Ⅱ ● ● ● ● ● ● CW JZ-Ⅰ ● ● ● CW JZ-Ⅱ ● ● ● ● CW JZ-Ⅲ ● ● ● ● SG-1 Ecological sand fixing agent Packages Packages:In 25KG/50KG/220KG drum or 1000KG IBC drum. Storage 1. Temperature: Store VAE emulsion in a cool and stable temperature environment. Avoid exposure to extreme temperatures, both high and low, as this can affect the stability of the emulsion. Generally, a temperature range of 5°C to 30°C (41°F to 86°F) is recommended. 2.Avoid Freezing: Protect VAE emulsion from freezing temperatures. Freezing can lead to irreversible changes in the emulsion's structure, resulting in a loss of performance. If the emulsion has been exposed to freezing conditions, it is advisable to thoroughly mix and test it before use. 3.Containers: Store VAE emulsion in tightly sealed containers to prevent air exposure. This helps to avoid evaporation of water and maintains the stability of the emulsion. Ensure that containers are kept in an upright position to prevent leakage and contamination. 4.Ventilation: Store VAE emulsion in a well-ventilated area to prevent the buildup of heat and humidity. Adequate ventilation helps maintain the quality of the emulsion over time. 5.Protection from Sunlight: Shield VAE emulsion from direct sunlight or ultraviolet (UV) radiation. Prolonged exposure to sunlight can potentially degrade the polymer and impact the emulsion's performance. 6.Avoid Contamination: Prevent contamination by using clean equipment and tools when handling or transferring the emulsion. Contaminants can affect the properties of the emulsion. 7.Regular Inspection: Periodically inspect stored VAE emulsion for any signs of separation, coagulation, or other abnormalities. If any issues are identified, investigate the cause and take corrective action as needed. 8.First In, First Out (FIFO): Use a first-in, first-out system to ensure that older batches of VAE emulsion are used before newer ones. This helps prevent extended storage periods and maintains product freshness. 9.ElephChem's Recommendations: Always refer to the specific recommendations provided by the ElephChem for the storage and handling of the particular VAE copolymer emulsion you are using. Different formulations may have specific requirements.

IPv6 network supported

IPv6 network supported