Dispersible polymer powder

Exclusive Team Member

EXPERT MEMBERSSatisfied Clients

TRUSTED PEOPLEOur Local & Global Stores

GLOBAL PARTNERMonthly production capacity

Ton

Embrace the New Year with JiangSu ElephChem Holding Limited! As the vibrant colors of the Spring Festival begin to brighten the streets and the spirit of renewal fills the air, Jiangsu ElephChem Holding Limited extends our warmest greetings and most sincere wishes to our global partners, clients, and dedicated employees. The Lunar New Year, also known as the Spring Festival, is the most significant traditional holiday in Chinese culture—a time for family reunions, reflection on the past year’s achievements, and setting ambitious goals for the future. Reflecting on Growth This past year has been a journey of "Chemical Change the World." Through constant innovation and a commitment to excellence in the chemical industry, ElephChem has reached new milestones. We owe this success to the unwavering trust of our international clients and the hard work of our entire team. The Spirit of the Horse In keeping with the festive spirit (and the majestic imagery of the horse which symbolizes speed, strength, and success), we look forward to "galloping" into the new year with even greater momentum. We remain dedicated to providing high-quality chemical solutions and fostering sustainable development across the globe. Looking Ahead May the Year of the Lunar New Year bring you and your loved ones boundless joy, prosperity, and good health. Let us continue to work together to create a brighter, more innovative future through the power of chemistry. Holiday Notice To allow our team to celebrate this cherished time with their families, please be advised of our holiday schedule: Holiday Period: February 15th to February 23rd Resume Business: February 24th Happy Lunar New Year! Wishing You a Year of Achievements and Abundance! Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com

On January 16, 2026, the Secretariat of Foreign Trade of the Brazilian Ministry of Development, Industry, Trade and Services (MDIC/SECEX) issued Notice No. 2 of 2026. At the request of the Brazilian company (ASK Crios Produtos Químicos Ltda), Brazil has formally initiated an anti-dumping investigation into phenolic resin products originating from China. The initiation of this investigation indicates rising trade compliance and cost risks for Chinese phenolic resin exports to the Brazilian market. Relevant exporters are advised to closely monitor the case and proactively assess its potential impact on their business operations. 1. Potential Impact on Chinese Phenolic Resin Exports to Brazil Based on Brazil’s previous anti-dumping cases, if the investigation results in an affirmative final determination, the following impacts may occur: A significant increase in export costs for phenolic resins originating from China Erosion of price competitiveness in the Brazilian market A shift by Brazilian customers toward alternative sources of supply Increased uncertainty regarding the profitability and performance of existing contracts For Phenolic formaldehyde resin producers and exporters that rely heavily on the Brazilian market, continuing with a single direct export model may present elevated operational and commercial risks. 2. Role of Third-Country Trade Arrangements in Risk Management Under a legal and compliant framework, third-country trade arrangements have become a commonly adopted risk management approach in international chemical trade. The underlying principles include: Anti-dumping measures are applied based on the determined country of origin If products are traded through a third country in full compliance with applicable regulations And obtain the corresponding origin status in accordance with origin rules The applicable trade measures upon entry into Brazil will be determined based on the recognized origin All related activities must strictly comply with the laws, regulations, and origin rules of the relevant jurisdictions. 3. Key Compliance Considerations in Phenolic Resin Trade Operations Given the characteristics of phenolic resin products, companies should pay particular attention to the following aspects when planning trade and logistics structures: ♣ Selection of Trade Hub Countries Certain Southeast Asian countries are often evaluated due to their mature chemical trade infrastructure and stable trade relations with Latin America. Final decisions should be made based on product form, HS classification, and Brazilian customs requirements. ♣ Origin Compliance Management Regardless of whether further processing is involved, strict adherence to origin rules is essential, including: Compliance with origin determination standards Lawful application for Certificates of Origin (CO) and related documentation Consistency across commercial, logistics, and customs documents ♣ Logistics and Documentation Structure Trade routes should be carefully designed to ensure that transportation, customs clearance, and re-export processes comply with local regulations, while maintaining a complete and consistent documentation system to mitigate compliance risks. 4. Recommendations for Exporters: Early Assessment and Strategic Planning In response to Brazil’s anti-dumping investigation on Chinese phenolic resins, exporters are advised to consider the following actions: Promptly review the product scope and relevant HS codes involved Exercise caution when accepting new direct export orders to Brazil Develop alternative and diversified trade pathway options in parallel Work with experienced professional service providers to ensure regulatory compliance Early-stage planning and systematic assessment can significantly reduce the operational and financial impact during the investigation period and after the final determination. 5. Conclusion Brazil’s initiation of an anti-dumping investigation into Chinese Phenoic formaldehyde resin highlights the increasingly stringent global trade environment for chemical products. The risks associated with relying on a single export route are becoming more pronounced. Against this backdrop, strengthening compliance management, optimizing market strategies, and enhancing trade risk control capabilities are essential for Chinese phenolic resin exporters seeking sustainable growth in Brazil and the broader Latin American market. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com

IPCC is the most influential coatings exhibition in the Middle East and Central Asia, and be held in Tehran from December 3rd to 6th, 2025. This unprecedented four-day event attracted nearly 500 exhibitors from around the world and over 30,000 industry professionals. As one of the most professional Polyvinyl Alcohol(PVA), Vinyl Acetate–ethylene Copolymer Emulsion(VAE Emulsion), and Chloroprene Rubber(CR) suppliers in China, Jiangsu ElephChem was invited to participate in this exhibition. ElephChem's booth showcased the company's latest achievements in industrial coatings, powder coatings, resins, and new surface treatment materials, with a focus on promoting its environmentally friendly water-based coatings and high-value-added functional coating solutions. Highlights and Response During the Exhibition Product and Technology Showcase Attracts Attention — ElephChem's exhibits covered industrial coatings, powder coatings, resins, and a variety of coating systems suitable for construction, automotive, and industrial equipment, meeting the needs of the Middle East and Iranian markets for weather-resistant, corrosion-resistant, and high-performance coatings. Many visitors expressed strong interest in its environmentally friendly and high-performance formulations. High-Quality B2B Negotiations — Leveraging the IPCC platform, ElephChem held in-depth discussions with dozens of distributors, coating equipment suppliers, and potential end-users from Iran and elsewhere, reaching preliminary agreements on agency partnerships, technology supply, and order collaborations. Market Potential and Strategic Value Widely Recognized — Exhibitors and industry peers expressed their anticipation for ElephChem's ability to bring advanced Chinese coating technology to the Iranian and even Middle Eastern markets. Many potential clients requested samples and product information on-site, hoping for further testing and cooperation. By participating in IPCC 2025, ElephChem successfully showcased its brand to the Iranian and Middle Eastern coating markets for the first time, laying the foundation for future business development in the region. This exhibition not only brought the company orders and potential cooperation opportunities but also provided valuable information on local market demands, regulations and standards, customer preferences, and the competitive landscape. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com

The three-day "China Coatings Show 2025" concluded successfully in Shanghai. JiangSu ElephChem Holding Limited, a key player in the industry, achieved great success at the exhibition, showcasing its latest innovative products and sustainable solutions. ♦ Innovation Leads the Future: Showcasing Cutting-Edge Technologies and Solutions At this exhibition, JiangSu ElephChem Holding Limited focused on core trends for the future of the coatings industry: high performance, environmental friendliness, and digital applications. The company's booth attracted professional visitors, partners, and industry experts from around the world. Highlights included: Next-Generation Environmentally Friendly Solvents and Additives: Several low-odor, high-efficiency, and environmentally friendly products were launched to meet stringent VOC (volatile organic compound) emission reduction requirements, attracting widespread attention from domestic and international customers. Functional Polymer Materials: A focus was placed on showcasing high-end resins and additives for water-based coatings, high-durability industrial coatings, and specialty adhesives. Supply Chain Optimization Services: Emphasizing the company's global advantages in raw material supply, quality control, and logistics management, providing customers with stable and reliable one-stop solutions. ♦ In-depth Cooperation: Exploring New Industry Opportunities Together During the exhibition, the senior management team of JiangSu ElephChem Holding Limited actively engaged in in-depth discussions with customers and partners, exploring current market challenges and opportunities. This participation in the exhibition was not only a successful showcase of the company's products but also a reflection of the company's commitment to promoting the upgrading of the global coatings industry chain and fulfilling its corporate social responsibility. With the successful conclusion of this exhibition, JiangSu ElephChem Holding Limited looks forward to growing together with all the partners who established connections at the exhibition, continuing to provide world-class products and services to the coatings and related industries, and jointly painting a more sustainable future. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com ElephChem Holding Limited, professional market expert in Polyvinyl Alcohol(PVA) and Vinyl Acetate–ethylene Copolymer Emulsion(VAE) with strong recognition and excellent plant facilities of international standards.

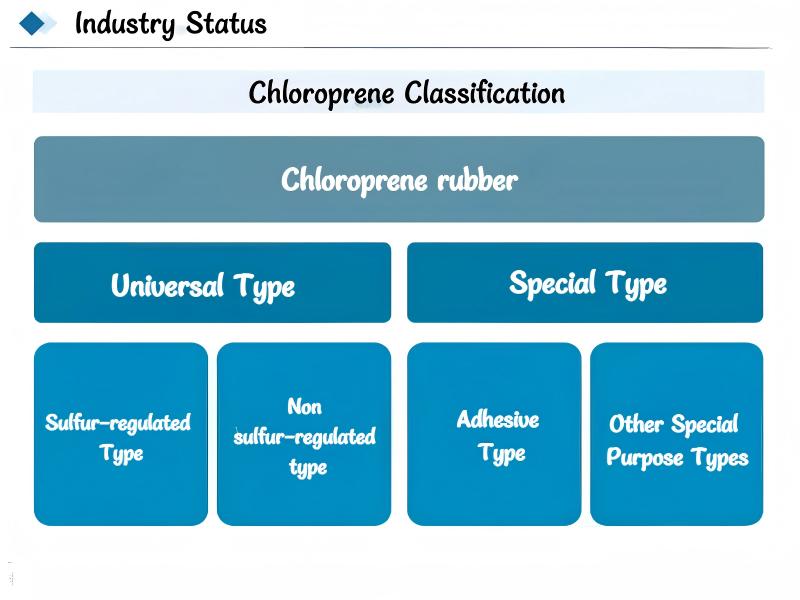

1. Industry Overview Chloroprene Rubber (Neoprene Latex) is a synthetic rubber produced by emulsion polymerization of 2-chloro-1,3-butadiene.Chloroprene rubber has chlorine atoms in its molecular structure, which gives it good resistance to oils, weather, flames, and chemicals. It also has acceptable mechanical properties and elasticity. DuPont first made CR in 1931 under the name Neoprene, making it one of the first synthetic rubbers to be produced on a large scale. CR comes in two types: general-purpose and specialty, depending on its properties and uses. 2. Industry Chain The chloroprene rubber industry depends on a few key components at the start of its process. These are mainly raw materials and the machines needed for production. Raw materials consist of things like chloroprene itself, along with catalysts, solvents, emulsifiers, initiators, antioxidants, and regulators. On the equipment side, you'll find polymerization reactors, emulsification equipment, degassing devices, packaging machines, waste gas treatment devices, wastewater treatment systems, and safety monitoring systems. Chloroprene rubber finds its main uses in products like transmission belts, sealing strips, hoses, rubber sheets, waterproof membranes, adhesives, anti-corrosion coatings, cable sheaths, and insulation materials. 3.Industry Status China is a major producer and consumer of chloroprene rubber. This industry has seen good growth because of rising demand from the car, construction, electronics, and medical device fields. From January to May 2025, China made 27,200 tons of chloroprene rubber, up 15.80% from last year. The consumption of this material reached 21,700 tons, which is a 30.67% increase compared to the previous year. In June 2025, the operating rate for China's chloroprene rubber plants was 38.74%. This is down 31.63% from May, but up 16.45% from June of the previous year. The lower rate is typical for June because demand is usually low then. Big industries that use the rubber, like car makers and construction, often adjust their production during this time. Specifically, the car industry saw slower demand for parts due to talk of fewer payments for new energy cars and car companies cutting prices. The construction business in southern China also used less waterproofing material because of the rainy season, which meant less neoprene rubber was needed. It didn't help that there were more global trade issues and that the EU started looking into whether China was selling rubber products too cheaply. This lowered the number of export orders and made demand even weaker. Between January and May 2025, China imported 6,900 tons of neoprene rubber, up 12.66% from the same period last year. The value of these imports reached 237 million yuan, an increase of 12.05% year-over-year. Over the same period, China's neoprene rubber exports totaled 10,400 tons, a 10.36% decrease from the previous year. The export value was 283 million yuan, down 15.24% compared to last year. Overall, my country's dependence on imported neoprene rubber is gradually decreasing, with imports increasing from 19,600 tons in 2020 to 17,300 tons in 2024, while exports are expected to increase from 11,000 tons in 2020 to 26,400 tons in 2024. 4. Industry Development Trends 4.1 Accelerated Development of High-End and Specialized Products Leading enterprises, by introducing DuPont's continuous polymerization reactor process and combining it with their independently developed neoprene latex flash degassing technology, have successfully developed high-end models such as Chloroprene Rubber DCR1141 and Chloroprene Rubber DCR2133. These products boast a 30% improvement in heat resistance and internationally leading chemical corrosion resistance. Leveraging 77 years of technological accumulation, they have built the world's first specialized neoprene rubber production line. The expansion of downstream applications further drives the high-end development process. The need for neoprene rubber is growing in new energy vehicles as it is used to seal and insulate battery packs. Also, the construction of 5G communication base stations has increased the usage of high-temperature neoprene rubber in electronic component packaging two-fold. 4.2 Green Manufacturing Becomes a Core Strategy Environmental policies are forcing the industry to accelerate its green transformation. The industry is increasing its R&D efforts in high-performance, environmentally friendly neoprene rubber products. 4.3 Deepening Global Layout Chinese neoprene rubber companies are shifting from scale expansion to value creation. Leading enterprises have obtained EU REACH certification and established R&D centers in Germany, resulting in a surge in sales in the European market. International competitive strategies are showing differentiation. The European and American markets focus on technological barriers, seizing high-end markets through customized products (such as medical-grade neoprene). At the policy level, the Belt and Road Initiative has boosted demand in participating countries, significantly enhancing the industry's international influence. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com JiangSu ElephChem Holding Limited, professional market expert in Chloroprene Rubber and Polyvinyl Alcohol(PVA) with strong recognition and excellent plant facilities of international standards.

As a leading company specializing in polyvinyl alcohol (PVA) and related high-performance chemicals, JiangSu ElephChem Holding Limited is actively making "Chemistry for a Cleaner, Greener, and More Prosperous Future" a reality. The company's sustainability strategy clearly identifies "circular economy, rational resource management, and collaborative co-creation" as core principles and outlines its "Zero Harm, Zero Waste" operational commitment. Environmental Highlights Strong Degradability and Solubility PVA, a polymer with greater environmental potential than traditional plastics, is water-soluble and biodegradable under certain conditions. According to industry analysts, PVA film materials are replacing non-degradable plastic packaging, helping to reduce plastic waste. Resource Management from Raw Materials to Production JiangSu ElephChem Holding Limited emphasizes resource conservation and waste minimization in its raw material procurement, production process design, and waste disposal processes. The company's website states that its product portfolio meets or exceeds most green certification standards. Promoting a Circular Economy Under the concept of a "circular economy," the company is committed to "recycling and reducing waste." It not only explores sustainable solutions within its own production processes but also collaborates with upstream and downstream stakeholders in the industry chain to promote the application of sustainable solutions. Advantages of PVA Products in Sustainable Applications In the packaging industry, PVA film can be used for water-soluble packaging, biodegradable packaging bags, and disposable product packaging, helping brands reduce their use of traditional plastics. In traditional industries such as textiles, building materials, and paper adhesives, PVA applications are also being optimized to improve production efficiency while reducing environmental impact. Market research shows that the PVA film market is growing at a compound annual growth rate of approximately 5.7%, primarily driven by rising demand for green packaging. The company will continue to increase its R&D investment in environmentally friendly PVA products and new materials (such as water-soluble films and modified PVA fiber) to meet market demand for "high-performance, low-environmental-impact" materials. It also plans to strengthen collaboration with customers, research institutions, and industry partners to explore the application of PVA in emerging fields such as sustainable packaging, biomedicine, and agricultural films. In this way, JiangSu ElephChem Holding Limited is not only transforming its products to be environmentally friendly, but also acting as a green driving force within the industry chain. Amid the global push for carbon neutrality and a circular economy, JiangSu ElephChem Holding Limited is actively assuming corporate responsibility, leveraging its expertise in PVA and related materials and its environmentally friendly strategy. Going forward, the company strives to bring greener, safer, and more efficient material solutions to a wider range of applications. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com JiangSu ElephChem Holding Limited, professional market expert in Polyvinyl Butyral Resin (PVB) and Polyvinyl Alcohol(PVA) with strong recognition and excellent plant facilities of international standards.

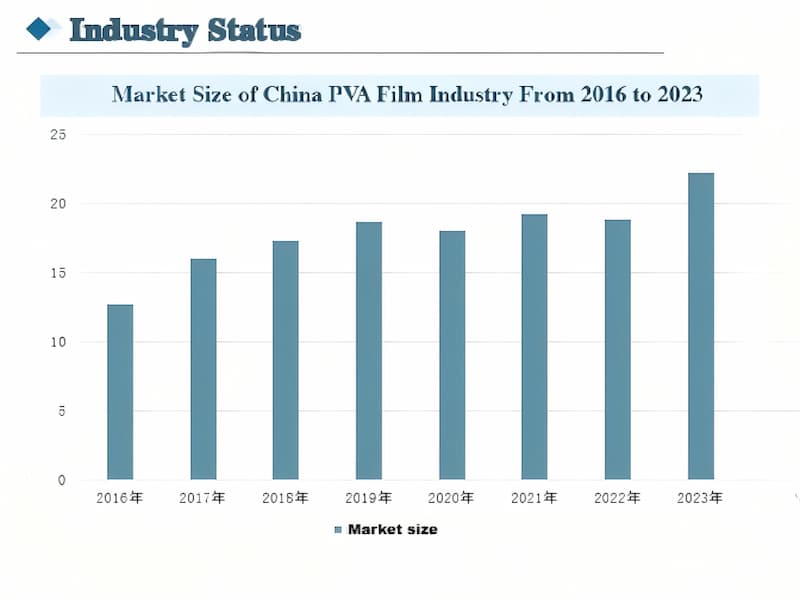

1. Industry Overview PVA film is a green, environmentally friendly, functional material made from polyvinyl alcohol (PVA) with modifiers and other additives, processed through a specialized process. It features excellent density, high crystallinity, and strong adhesion. The film produced is flexible, smooth, resists oil and solvents, resists scrapes, and blocks gas well. Furthermore, PVA film is biodegradable by bacteria and enzymes, making it a biodegradable polymer material with good environmental compatibility and pollution-free properties. 2. Industry Development History The development of China's PVA film industry has primarily progressed through five phases. The early exploration phase, from the 1950s to the 1970s, saw the initial application of optical PVA film in areas such as projectors and televisions in the 1950s. However, the overall scale of application was small, and the technology was in its early stages of development. During this period, China's chemical industry had a relatively weak foundation, with PVA film production technology primarily dependent on imports. Domestic research and application of this technology was in its infancy. From the 1980s to the 1990s, China experienced a period of rapid development. With the rise of liquid crystal display technology in the 1980s, optical PVA film gained widespread application, leading to rapid growth in market demand. China began introducing advanced foreign technology and equipment, attempting to domesticate PVA film production. While some companies ventured into this field, the overall technological level still lagged significantly behind that of foreign countries. From the 1990s to the early 21st century, China experienced a period of steady growth. In the early 21st century, the optical PVA film industry gradually matured, with continuous technological advancements, significant improvements in product performance, and a further expansion of its application areas. Through technological accumulation and independent innovation, some domestic companies gradually mastered the core production technology for PVA film, continuously improving product quality and production scale, and began to capture a significant share of the domestic market. From the early 21st century to 2020, China experienced a period of diversified development. In recent years, the application areas of optical PVA film have continued to expand. Beyond traditional display applications, it has also been widely used in mobile phone screens, e-book readers, touch screens, polarizers, and other applications, resulting in continued market demand. Domestic companies are increasing their R&D investment and continuously exploring new production processes and material formulations, driving the development of PVA film products towards high performance, high quality, and customization. During the rapid growth period since 2020, with the rapid advancement of emerging technologies such as flexible displays, photovoltaic cells, and fuel cells, the application of PVA film in these fields has continued to expand, driving the industry towards high-end, intelligent, and green development. The Chinese government has introduced a series of policies to support the development of the new materials industry, including R&D investment and tax incentives, providing strong support for technological innovation and industrial upgrading in the PVA film industry. 3. Industry Status In 2023, the market size of China's PVA film industry is expected to reach 2.22 billion yuan, an increase of 18.09% year-on-year. The sales figure is the highest in five years, showing that environmentally friendly materials are doing well, even though the traditional plastic film market is slow. Because of good policies and tech improvements, more areas are using PVA film, like electronics, IT, energy, and health. In the electronics and information technology sector, with the development of technologies such as 5G and the Internet of Things, demand for high-performance, thin, and transparent PVA film is increasing. In the new energy sector, PVA film, as a lithium battery separator material, can improve battery safety, energy density, and cycle life. Furthermore, with growing environmental awareness, PVA film's application in biodegradable packaging, biomedicine, and other fields is also increasing. This diversified market demand provides broad growth opportunities for the PVA film industry, driving the industry's transition from a "substitute" for traditional plastic films to a "mainstream material" across various fields. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com JiangSu ElephChem Holding Limited, professional market expert in PVA film and Polyvinyl Alcohol(PVA) with strong recognition and excellent plant facilities of international standards.

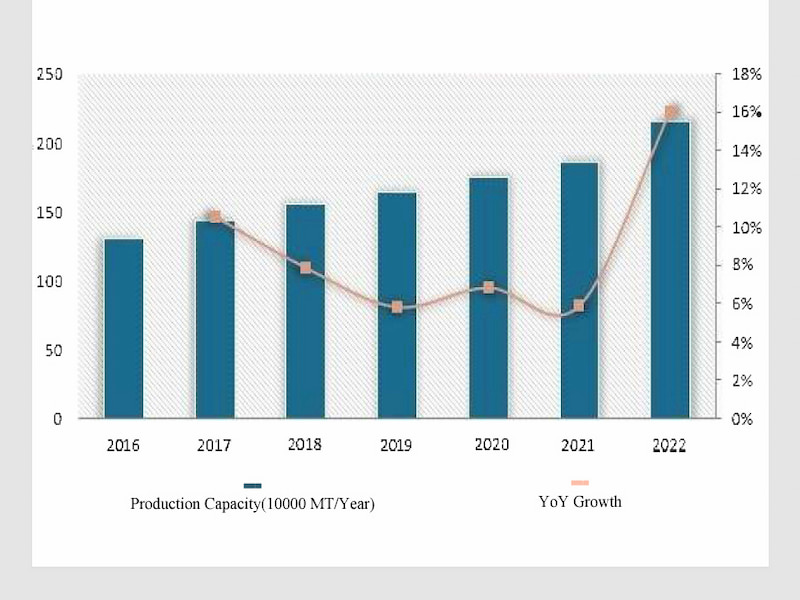

1. Phenolic Resin Overview Phenolic resin is a general term for resinous polymers formed by the condensation of phenol and aldehyde in the presence of an acidic or alkaline catalyst. It typically refers to resins obtained by the condensation of phenol or its homologues (such as cresol and xylenol) with formaldehyde. Phenolic resins offer excellent heat resistance, flame resistance, water resistance, and insulation properties. They are widely used in a wide range of applications, including phenolic molding compounds, woodworking and laminates, abrasive and friction materials, and fire-resistant and thermal insulation materials. 2. Phenolic Resin Production Capacity and Output Steadily Rising In recent years, driven by downstream demand and relevant policies, my country's phenolic resin industry has developed relatively steadily, with both production capacity and output showing a steady upward trend. Data shows that production capacity, primarily in East China and Central China, will increase from 1.3 million tons in 2016 to 2.1524 million tons in 2022. Production will also increase from 1.036 million tons in 2016 to 1.535 million tons in 2022. Currently, my country's phenolic resin industry still faces a phenomenon of "overcapacity at the low end and insufficient supply of high-end products," leaving significant room for domestic production of high-end products. 3. Phenolic molding compounds are the largest downstream demand segment for phenolic resins Based on their purity, phenolic resins can be divided into two categories: electronic grade phenolic resin and industrial-grade phenolic resins. Industrial-grade phenolic resins are primarily used in phenolic molding compounds, wood processing and laminates, abrasive and friction materials, and refractory materials. End-use applications include automotive, construction, metallurgy, and rail transportation. Electronic-grade phenolic resins are high-performance, high-value-added phenolic resins, primarily used in chip photoresists, electronic packaging, and copper-clad laminates. End-use applications include semiconductors, aerospace, and consumer electronics. Among them, phenolic molding compounds, grinding and friction materials, and wood processing and laminates are the three downstream application areas of phenolic resin in my country. Their market shares have remained relatively stable in recent years, reaching 21.94%, 20.17%, and 20.01% in 2021, respectively. In recent years, my country's downstream phenolic resin industry has developed well overall, with demand for phenolic resin steadily increasing, from 1.0423 million tons in 2016 to 1.5423 million tons in 2021. It is worth noting that due to the high technical barriers to electronic-grade phenolic resin, only a few companies in China can currently produce it. Supply currently cannot meet domestic market demand, and imports are needed to supplement it. 4. The import value and average import price of phenolic resin have consistently exceeded the export value and average export price Data shows that in recent years, my country has imported over 80,000 tons of phenolic resin annually, primarily high-end phenolic resin, reaching 86,000 tons in 2023, a slight year-on-year increase of 0.94%. Exports have remained above 90,000 tons, reaching 125,100 tons in 2023, an 18.69% year-on-year increase. Due to the high added value of high-end phenolic resins, my country's import volume and average import price of phenolic resins have always been higher than its export volume and average export price. Data shows that since 2021, its import volume has declined year by year, but its export volume has shown an annual growth trend, reaching 2.045 billion yuan and 1.542 billion yuan in 2023, respectively, a year-on-year decrease of 7.76% and an increase of 10.94%, respectively. With the decline in import volume of phenolic resins and the increase in export volume, its trade deficit has shown a shrinking trend since 2021, falling to 503 million yuan in 2023. Website: www.elephchem.com Whatsapp: (+)86 13851435272 E-mail: admin@elephchem.com JiangSu ElephChem Holding Limited, professional market expert in Phenolic resin and Polyvinyl Alcohol(PVA) with strong recognition and excellent plant facilities of international standards.

Signup our newsletter to get update information, promotion and insight.